Cyber threats are becoming increasingly common for small and medium-sized enterprises. Here are some factors you should consider when choosing the best IT insurance for your company.

Any company with access to the Internet and important data on customers and employees can be the victim of a (potentially very damaging) hacker attack.

Cyber insurance is a necessity that every business owner should have in order to be truly confident about the security of emails, accounts and company data.

So here's how to get computer insurance in 4 easy steps:

- Decide which type of cover best suits you

When looking at computer insurance policies, there are two main types of coverage:

- coverage for financial loss due to a breach of the insured's data;

- coverage for financial loss resulting from a breach of third-party data (including that of your customers, partners, suppliers, vendors or other associates);

If your company does not manage a lot of external data, you might prefer to cover only your own data. However, most companies collect various data on their customers, such as names and contact information.

If you also operate in the same way then you may need coverage on both aspects.

- Know your contractual obligations

It is becoming increasingly common for customers and suppliers to require some form of insurance on the data managed by the companies they interface with. Many even require it in their contracts.

Therefore it is important to carefully consider IT insurance also on the basis of the demands of your (current or potential) customers and suppliers.

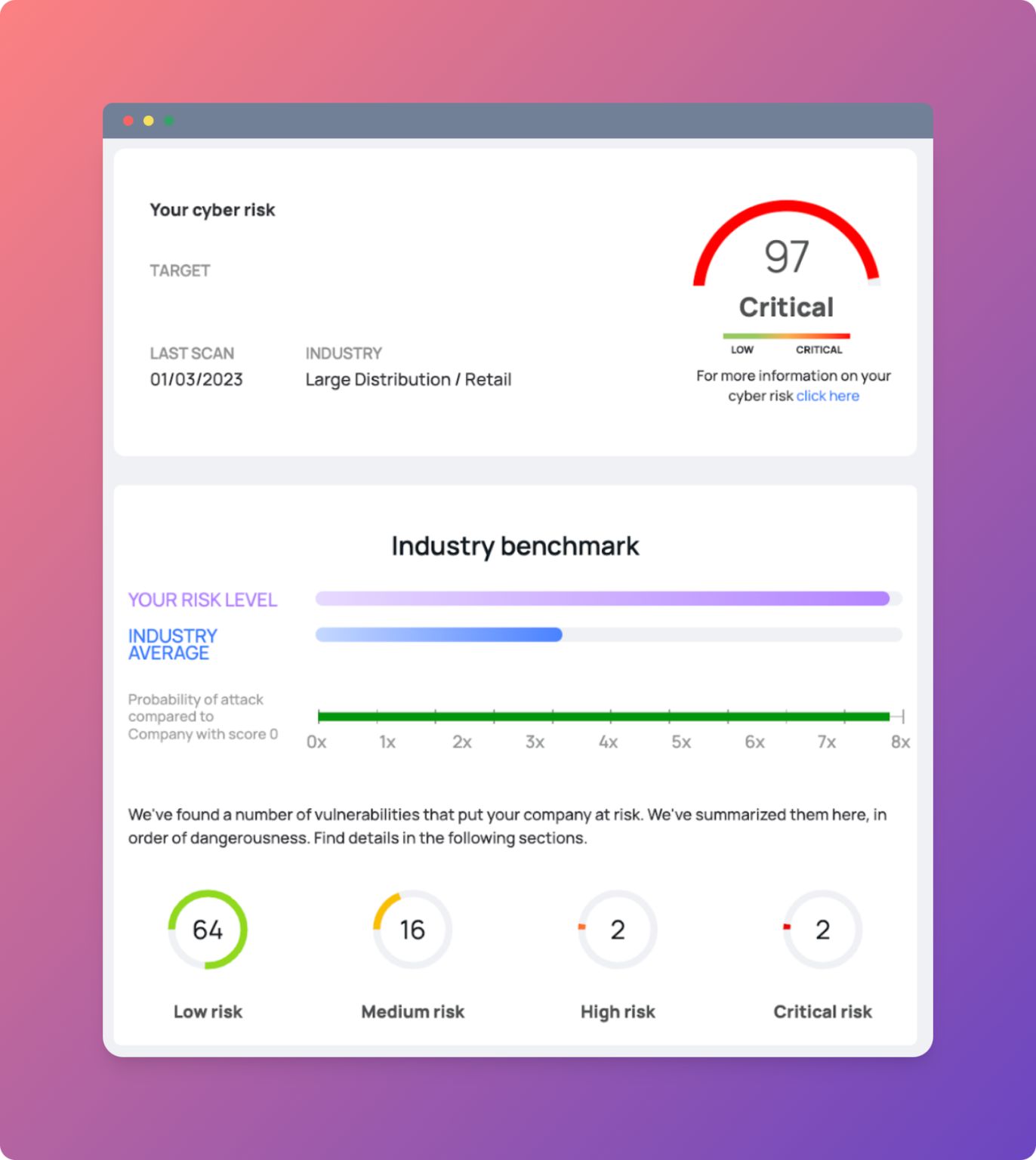

- Assess your risk

Assess what kind of sensitive information your company collects, such as payment information, personal information or health information.

This type of data in particular is an attractive target for cybercriminals. The more sensitive data you handle, the more important it is to carefully assess which cyber insurance you can rely on.

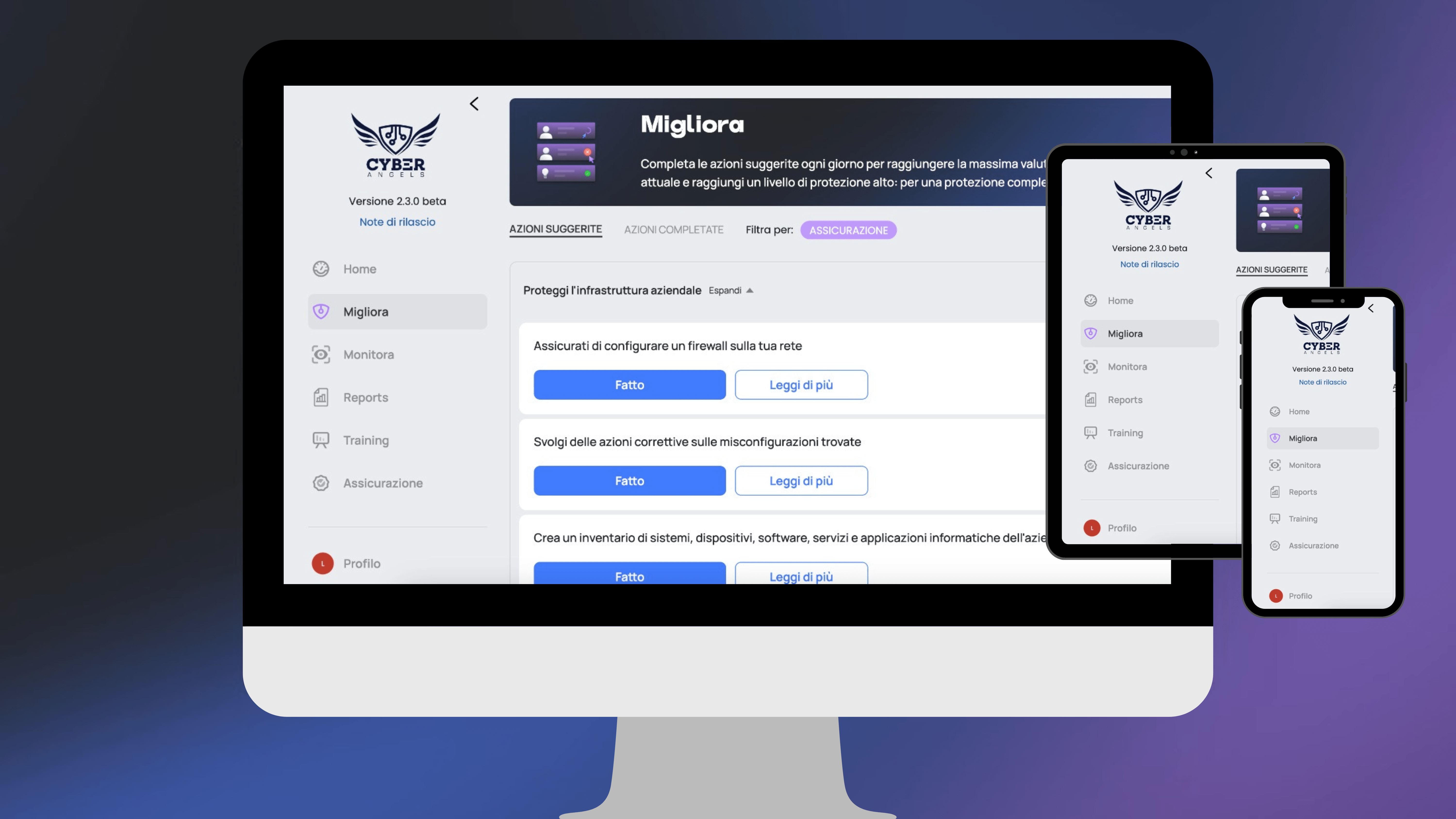

- Find out what you need to make your policy effective

As with health and car insurance, certain terms and conditions must be met before coverage is activated.

Carefully determine whether you need a policy with comprehensive coverage or one that focuses on specific types of cyber attacks.

And remember to comply with all safety requirements so that the insurance company is obliged to pay compensation.

These simple tips will help you to properly protect your company against cyber damage.