Traditional insurance protects companies from the classic situations that occur in the course of business operations (property damage, legal liability, employee risks, etc.).

In recent years, business operations have increasingly shifted towards digital. Think of those businesses that rely entirely on the Internet, such as e-commerce.

The risks generated by cyber-attacks are among the most likely to occur in the digital age, yet traditional insurance hardly covers them.

Insurance against cyber attacks operates like normal insurance, but unlike insurance, it protects you against the economic risks associated with your daily dealings with the Web..

These risks are usually not defined in conventional insurance policies. As a result, the victim company finds itself without cover against the cyber attack it suffers.

TYPES OF COMPUTER INSURANCE

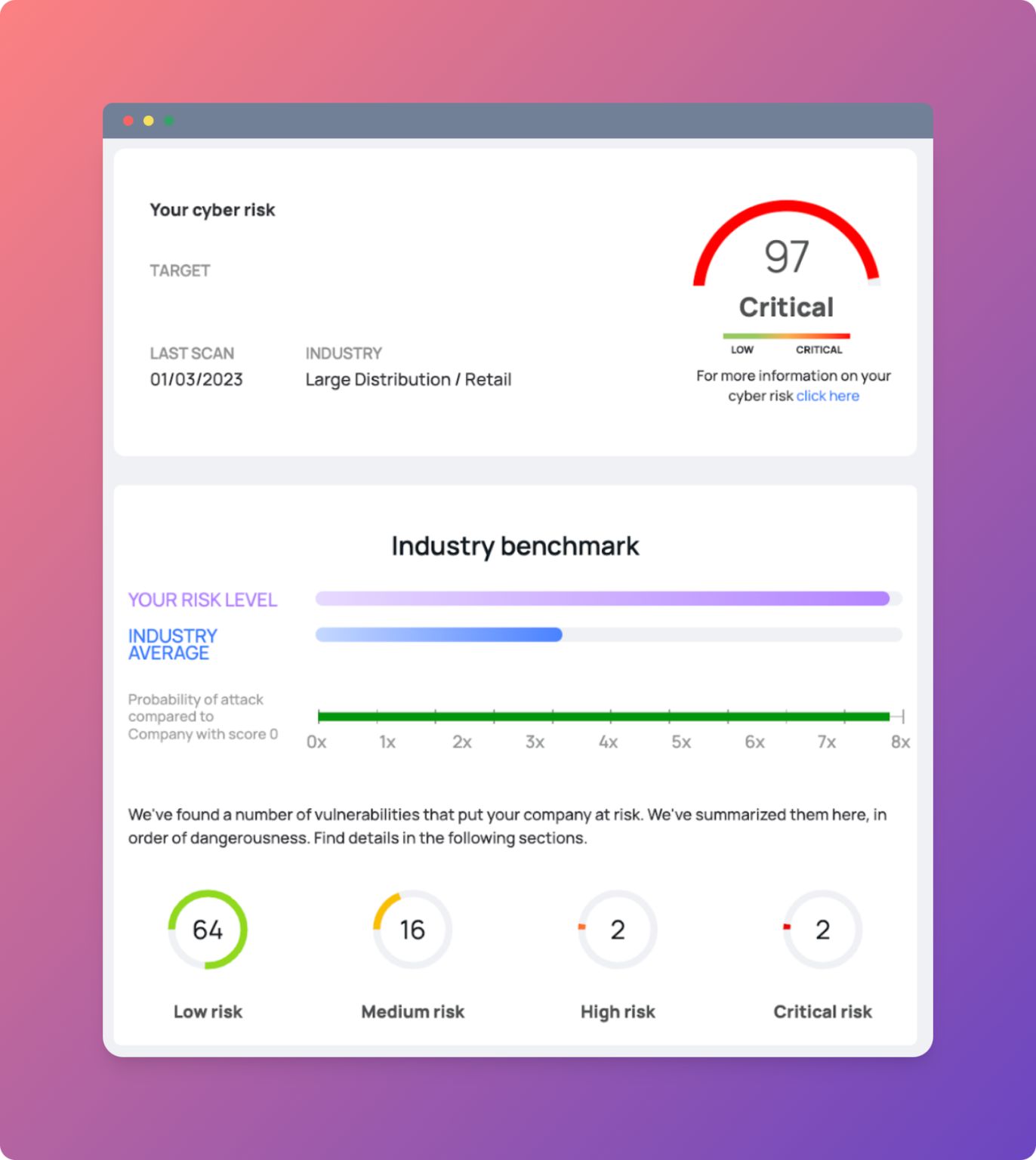

IT insurance offers protection of digital business processes at different levels.

Some of the common types of computer insurance we have are:

Hacksurance:

Insurance is offered against cyber attacks and hacking of computer systems, servers and databases.

Theft and fraud:

Insurance is offered against data theft on the network and against losses caused by transactions based on fraudulent connections.

Forensic investigation:

Insurance is offered to cover all costs of technical, legal or forensic services needed to investigate the causes and perpetrators of a cyber attack.

Business interruption:

The insurance covers cases where the entrepreneur is no longer able to conduct business due to a network breach or any other cause of a cyber nature.

Extortion:

Insurance is offered to cover any threat of a potential cyber-attack that could make sensitive and relevant information public.

Reputation insurance:

Insurance is offered against attacks that could damage the company's reputation.

Loss and restoration of computer data:

Insurance is offered against data loss caused by a cyber attack on hardware and/or software, with subsequent data recovery.

The need for IT insurance for small and medium-sized enterprises

In 2011, Sony's PlayStation brand was hacked, costing the gaming mogul $ 171 million. Analysts commented that the company could have avoided such a loss if it had opted for IT insurance.. In addition to the financial loss, the incident also led to a lack of trust in the company due to its weak IT protection.

Adapting Warren Buffett's phrase: "it takes 20 years to build a reputation and one cyber attack to ruin it'.

Any organisation that stores data online is at risk of attack.

Large organisations employ entire teams for IT security but the same cannot be said for SMEs.

Beyond 30% (Symantec Intelligence Report) of phishing attacks are launched against organisations with fewer than 250 employees. In addition, almost the 43% of cyber attacks is aimed at smaller organisations.

The annual and global economic loss caused by cybercriminals is estimated to be up to between $ 375 and $ 575 billion.

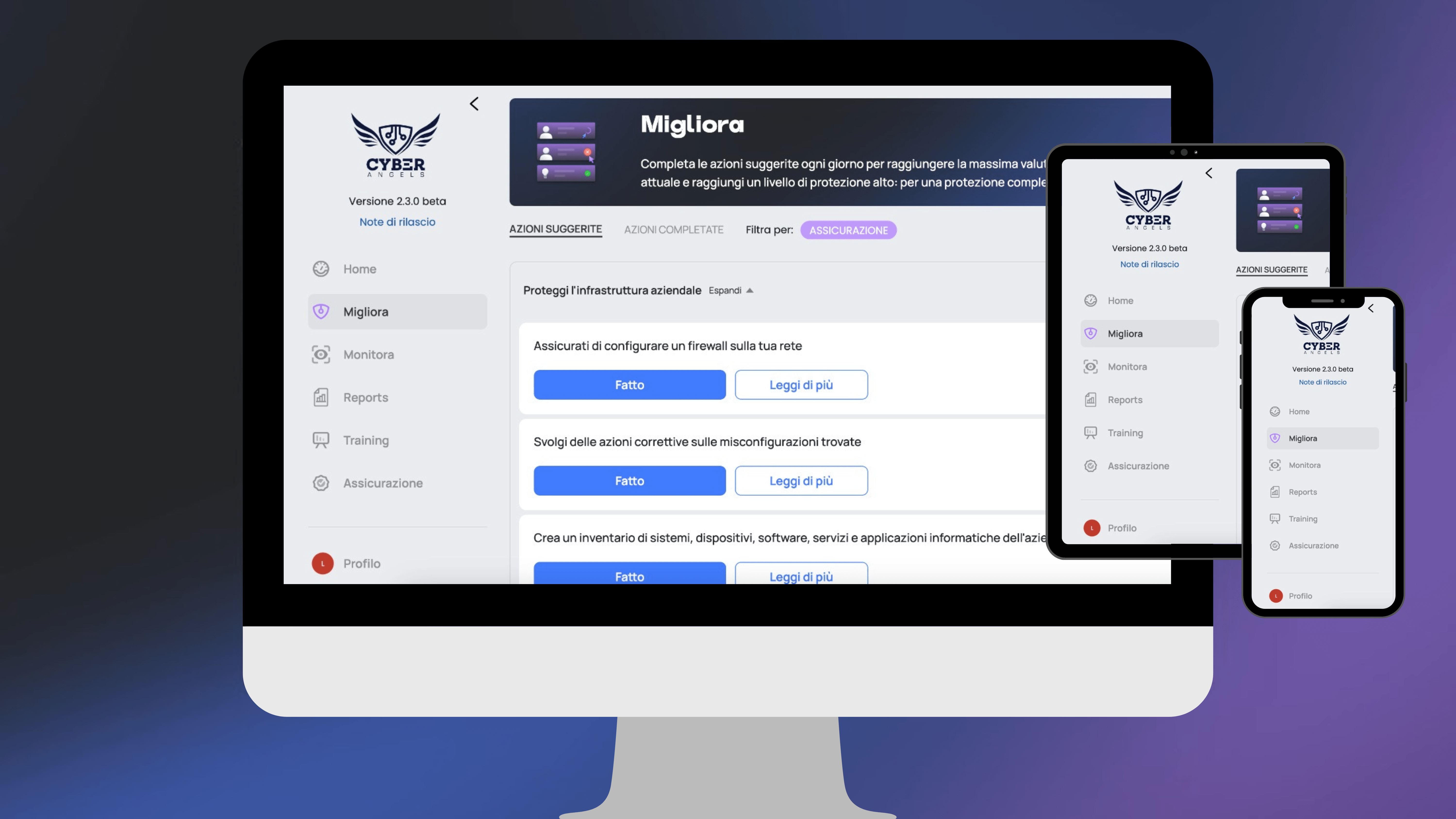

Considering all these factors, it is now more important than ever for a company to prevent cyber attacks and insure itself against economic damage. This is to avoid being caught by your insurance company as a result of a cyber criminal's actions.

If you want protection and insurance against cyber risks, you can subscribe to our Cyberangels platform, dedicated entirely to cyber protection for SMEs.